Corporate Governance

Basic Views and Policies on Corporate Governance of JSR

1. Basic policy

- (1)It is the JSR Group's goal to make steady progress in realizing its corporate mission (Materials Innovation: We create value through materials to enrich society, people and the environment). This shall be done through efficient and transparent business management, by sustaining sound and healthy business practices. The Group will also continuously strive to create new corporate values with the hope of becoming an attractive corporation that can earn the trust of and satisfy the interests of all our stakeholders.

- (2)JSR therefore has been and will continue focusing on the enhancement of corporate governance as an important management challenge.

2. Corporate governance structure

- (1)As a company with Corporate Auditors, JSR principally monitors and oversees the execution of duties by directors and the management through its Board of Directors and Corporate Auditors.

- (2)The Board of Directors established JSR's corporate mission and makes important decisions including those of JSR's business strategies.

- (3)The Board of Directors developed an environment where management can take appropriate risks and demonstrate entrepreneurship through the introduction of a performance-based director remuneration framework.

- (4)The Board of Directors supervises directors and management through the assessment of business performance and appointment of directors.

- (5)JSR established the Remuneration Advisory Committee in order to ensure the objectivity and transparency of its directors' remuneration framework. The committee deliberates on fundamental compensation policies, the compensation structure, performance-linked mechanisms, goal setting, and performance evaluation, and subsequently submits recommendations to the Board of Directors.

- (6)

JSR set basic policies on remuneration of directors as follows: the remuneration scheme should increase corporate value over the medium and long-term, attract diverse and superior personnel, be linked to short-term, medium-term and long-term business performance, have management and shareholders share profits, while maintaining a high level of transparency.

- (7)

JSR established the Nomination Advisory Committee to ensure the transparency of the policy and procedures of nominating candidates for directors. The committee deliberates criteria for the size(number of people) and diversity in terms of breadth of knowledge, experience, capability, gender, international consciousness, work history, age, and other factors necessary for the Board of Directors as well as criteria and procedures for nominating and/or identifying candidates for future appointment as the CEO and President, directors, officers with directorship status (including senior officers), and submits its findings to the Board of Directors. For the successor to the CEO and President, the committee, in addition to acquiring talent externally, provides necessary education and training to multiple internal candidates and is actively involved in the selection process. This ensures that successors are systematically developed and selected through objective and transparent procedures.

3. Relationship with stakeholders

- (1)JSR established "Responsibility to Our Stakeholders" (responsibility to customers, business partners, employees, society, and shareholders) as one of the important pillars of its management policies in order to express its commitment to its stakeholders.

- (2)JSR appropriately responded to issues related to sustainability, such as social and environmental issues and also promoted measures to secure diversity including those for encouraging greater participation of female employees.

For details of JSR's Sustainability, please visit the following site:https://www.jsr.co.jp/jsr_e/sustainability/index.html - (3)To fulfill its commitment to its stakeholders as stated in its "Responsibility to Our Stakeholders", the JSR Group established "the JSR Group Principles of Corporate Ethics" as a code of conduct for its directors and employees and endeavored to ensure the code is thoroughly communicated to, and understood and observed by all directors and employees.

For details of the JSR Group Principles of Corporate Ethics, please visit the following site:

https://www.jsr.co.jp/jsr_e/sustainability/governance/compliance.html

4. Information disclosure policy

- (1)

JSR established its information disclosure policy and prepared organizations and systems for information disclosure. JSR has strived to ensure prompt, accurate, active and fair disclosure of information by establishing a company-wide cooperative framework to improve the quality of information disclosure.

- (2)With the aim of actively providing company information, JSR has been posting such information on its website as corporation information including business performance, financial position, and details of main businesses, sustainability promotion activity including CSR information such as efforts to conserve the environment and responsible care (RC), and research and development (R&D) activities.

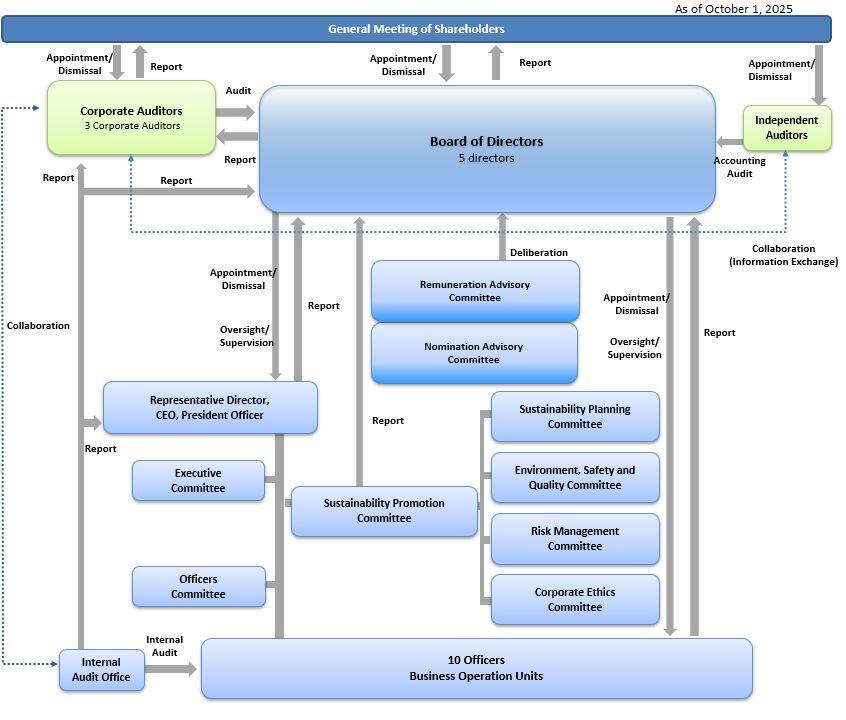

Corporate Governance Structural Diagram

Management System

1. Board of Directors

The Board of directors consists of five (5) directors and holds meetings once monthly, in principle. The Board discusses and makes decisions on important business matters, including the direction of JSR's business strategy, and also supervises directors' and officers' execution of their business duties. Shogo Ikeuchi serves as the board’s chairperson.

In addition, all three (3) Corporate Auditors regularly attend the Board of Directors meetings to state their opinions. In total 21 meetings were held in fiscal year 2024 ending in March 2025, of which attendance ratio was 100% (all of the members of directors and Corporate Auditors attended all of the meetings). JSR has established the Remuneration Advisory Committee and Nomination Advisory Committee as an advisory organization to Board of Directors.

2. Executive Committee

In order to speed up the decision-making process and improve the efficiency of business operations, the Executive Committee, consisting of the CEO and President, and officers or general managers appointed by the CEO and President, meets once a week as a rule to discuss and give direction to matters relating to the Group’s fundamental management initiatives, management policies, business issues and management plans, along with important matters concerning the execution of business activities at each business division, or to receive reports. Of the matters deliberated by the Executive Committee, important items are passed to the Board of Directors, while the rest are decided on by the CEO and President after deliberation by the Executive Committee. A standing Corporate Auditor also participates in the meeting.

3. Officers Committee

This committee, consisting of the CEO and President and all officers, aims to ensure members’ thorough understanding of business conditions and important business matters. Standing Corporate Auditor also attends the committee’s meetings.

4. Corporate Auditors

There are three Corporate Auditors in place and they are holding liaison meetings once monthly in principle, receives reports on important matters, holds discussions, and makes decisions.

In accordance with standards for audits by Corporate Auditors, Corporate Auditors attend meetings of the Board of Directors, and other important meetings including Executive Committee meetings to monitor how important decisions are reached and business activities are executed. Corporate Auditors also receive reports from the independent auditors, directors, and employees. Through these activities, Corporate Auditors form auditing opinions.

5. Outline of Audit by Corporate Auditors, Internal Audit, and Independent Auditors

- (1)Audit by Corporate Auditors

The details of audit by Corporate Auditors are stated as in the above 4. Corporate Auditors. - (2)Internal Audit

JSR has established the Corporate Audit Department to improve the effectiveness of the JSR Group's internal control system. In accordance with the audit plan, the Corporate Audit Department regularly conducts internal audits such as compliance audits and business operation audits at its divisions and departments as well as its Group companies both in Japan and overseas and reports the audit results to CEO and President, related departments, and the standing Corporate Auditor and also regularly reports internal audit plans and reports of internal audit results to the Board of Directors and Corporate Auditors liaison meeting.

- (3)Independent Auditors

JSR's independent auditor is KPMG AZSA LLC. Corporate Auditors work closely with the independent auditors. Corporate Auditors interview the independent auditors about the audit plan and receive reports on the audit results. Furthermore, Corporate Auditors and independent auditors exchange information and opinions as necessary in the course of each fiscal year.

6. Sustainability Promotion Committee

In order to establish good relationships with various stakeholders and to become a company that is trustworthy and indispensable, the JSR Group has established the “Sustainability Promotion Committee” (SPC) with the purpose of promoting sustainability activities that contribute to all stakeholders by creating value through corporate activities. The SPC has been established as a cross-functional meeting body chaired by the CEO and President of the Company to facilitate the practical implementation of sustainability activities. The SPC is a meeting body that deliberates and coordinates sustainability-related matters, including the Sustainability Action Policy, in light of domestic and international developments related to ESG and the SDGs. Made up of the executive officers in charge of corporate planning, production engineering, procurement & logistics, quality assurance, environment & safety, R&D, human resources development, accounting, finance, public relations, general affairs, legal & compliance, systems strategy, cyber security management, sustainability promotion, diversity promotion, the digital solutions business, the life sciences business, and the plastics business, it operates so as to cover every functional department and business division of the JSR Group. There are four committees operating under the SPC: the Sustainability Planning Committee, the Environment, Safety, and Quality Committee, the Risk Management Committee, and the Corporate Ethics Committee. The SPC oversees and guides the activities of these four committees, and endeavors to strengthen and promote management through regularly scheduled meetings held, in principle, four times a year, as well as extraordinary meetings. Reports of the SPC’s activities are also made to the Board of Directors.